As a sign of personal growth, I did not attend MIF (Metals Investors Forum) this weekend. There were no companies or speakers I was interested in seeing nor do I necessarily want to hear new pitches for fear I’ll take a punt on a shitco.

I did attend VRIC (Vancouver Resource Investment Conference). I had allotted about 3.5 hours to attend. After watching two Lobo Tiggre talks, a few CEOs quickly ate up my time. I forgot how much these guys like to talk about their stock. It can actually be hard to get away. The conference was fairly well attended, even though it was a Monday afternoon.

Here are some notes on companies.

Disclaimer: This post contains forward-looking statements. These statements are based on my memory and rough notes, and as such, they may not accurately represent information about the relevant companies or the views of the interviewees. This content is provided for informational purposes only and is not intended as investment advice.

ALDE.V (Aldebaran Resources)

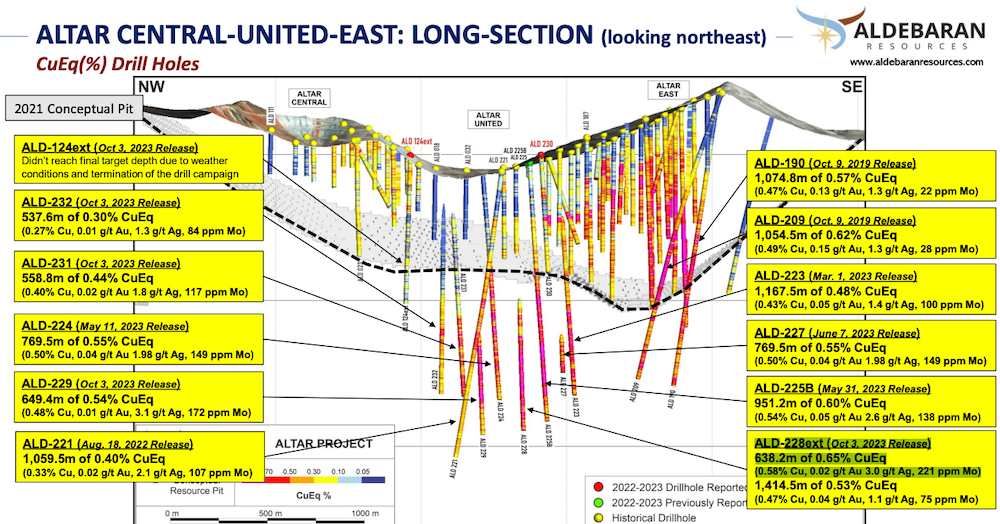

I spoke with CEO John Black, who I spoke with last year. Dave Lotan recommended ALDE as a copper play because of his opinion of John Black. Aldebaran’s main asset is called Altar, which is located in the mining-friendly province of San Juan, Argentina. They are earning into the project through a JV with Sibanye-Stilwater. They currently own 60% of the project. The 2021 MRE (Maiden Resource Estimate) was about 1.2 billion tonnes (M&I) of approx 0.43% CuEQ.

Since then, they’ve been drilling it out to expand the resource considerably and hitting higher grades at depth. An example hole from last year: ALD-228ext (Oct 3, 2023 Release) 638.2m of 0.65% CuEq (0.58% Cu, 0.02 g/t Au 3.0 g/t Ag, 221 ppm Mo).

They have 4 rigs currently drilling. The current program is 15-20,000 meters, which is a good size. They are drilling the margins of the deposit; John says to expect lower grades on the margins, but these holes are important in expanding the resource.

What I like about ALDE.V:

- John Black has a history of success in selling assets in LatinAm. He seems like an honest character who takes a practical approach to advancing the project.

- Copper

- Though there are 169M shares outstanding, the shares are fairly tightly held with Route One Holdings having 44.09%, Sibanye-Stillwater at 14.35%, South32 at 14.82%, and insiders at 5.27%. dd That’s 78.5% of the shares. (This is a strength, but also the reason why the stock has held within the 90-70c range over the past year.

Concerns about ALDE.V:

- Technological dependence: Perhaps dependence is too strong of a word, but they are looking to improve the project with Rio Tinto’s Nuton Technology. This tech will allow them to recover the copper sulphides via a heap-leaching process. This is good because it will increase the recoverable ore and also because the heap-leaching process is less water-intensive. Getting water is a problem in the Argentinian mountains. Heap-leaching also means no tailings, since they won’t be creating a concentrate. This makes the project much greener. Currently John is testing the Nuton technology on his Regulus (separate company) asset in Peru. They will know in a year to what extent the Nuton Tech can enhance their project. I should note that Nuton is also critical for the Altar project as the grade is lower.

- Water: John says this is always an issue for Argentina plays. If they can get Nuton Technology working, it should be less of an issue.

- Arsenic: There are areas that will result in smelter penalties due to higher levels of As. However, much of the deposit is not high in arsenic.

- Glacier Laws: This isn’t really a concern. But there are laws related to glaciers and mining in Argentina. John said that one challenge is the ambiguity of what constitutes a glacier (e.g. is a moraine a glacier?). John did not seem overly concerned because there are no actual glaciers near the asset (if I remember correctly); also with the new President, Milei, it seems less likely that this law would cause an issue.

- Ownership: The company still needs to spend more to earn 80% of the project. Hopefully they will be within this number in a year.

Plans for moving forward:

- Continue to drill and then release an updated resource estimate by Q4 2024.

- Publish a PEA in early 2025. This date coincides with when the company will know about the success of the Nuton Tech on their Regulus asset. I assume this means that if Nuton proves helpful, its benefits could be factored into the PEA.

Overall, I emerged from the conversation bullish on Rio Tinto and its Nuton technology. It sounds like it will be a game-changer. It is being tested at Arizona Sonora Copper Company (ASCU.V).

My plans are to continue to monitor ALDE and wait for an irresistible entry point, which may be hard to come by given the small float. Altar will continue to move forward. It will be interesting to see how Nuton can benefit it.

Disclaimer: These ideas were taken from a conversation and likely contain errors due to memory failure.

Altius Minerals (ALS.TO)

My conversation with VP Generative & Technical Lawrence Winter wasn’t very comprehensive because I was just doing a fly-by. Altius Minerals is a long-term hold in my portfolio so honestly the month-to-month plans of the company aren’t something I worry about.

Nevertheless, I asked about near-term catalysts. Lawrence discussed the Kami iron ore asset, which is owned by Champion Iron Ore, a name I’d already heard good things about. This asset may be 4 years away from production, but ALS has a 3% royalty on it. Kami will apparently produce a high-quality DR grade pellet which will be in demand.

He also mentioned the 1.5% NSR Altius has on the Silicon gold asset in Nevada, operated by Anglogold (bought from Orogen). There is arbitration in process about the definition of the word ‘contiguous‘. In essence, (how I understand it), Altius’s NSR applies to any contiguous claims originating from the Silicon deposit. As you can see on the map, Angogold has another asset that is being advanced–North Bullfrog. Altius’s claim is that the NSR should also apply to that asset because the company has contiguous (uninterrupted) claims extending from Silicon to North Bullfrog, i.e. there are no other operators in between the assets that break up the line of ownership.

The result from this arbitration should be coming early summer.

Regardless of the result, I will continue to be an ALS.TO (and ARR.TO) shareholder.

Mirasol Resources (MRZ.V)

MRZ is not a holding; I did a fly-by though because the company owns property in the hot Vicuna district of Argentina, nearby NGEX and Filo’s properties. These assets are called Sobek Central and Sobek North (near NGEX).

The company’s main recent accomplishment is finishing a road to Sobek Central. The plan for February is a small drill program of (up to) 3,000 meters split between Sobek Central and Sobek North. They are currently doing geophysics as well, which will inform the drill program. News likely in June.

The company has 3.5 million in the bank and will need to go bank to the market afterward to raise $.

I plan to pay attention to the drill results in June, but otherwise, hold off. The exploration of the properties in Vicuna sounds like it will progress slowly.

Disclaimer: This content is for informational purposes only and should not be construed as financial advice. The views expressed are those of the author, who is not liable for any losses or damages arising from any actions taken based on the information provided in this blog. Investing and trading involve risk; you are solely responsible for your decisions.